Your credit score determines whether you are eligible to avail a personal loan. People with low scores generally cannot acquire these loans, but there are certain opportunities that you can utilize to avail a loan even when your credit rating is not sufficient. Here are 5 ways to secure a Bajaj Finserv Personal Loan with a poor credit score.

Increase Earnings

Personal loan applicants with poor credit ratings can avail the same if they have a high monthly income. If your job does not pay enough, you can look for additional sources of income. Bolstering your earnings not only makes availing loans easier but also helps during repayment.

Check For Errors in Your Credit Report

While not common, errors in a CIBIL report may happen. If there are errors present in your report, you must inform the authority immediately to rectify the mistake. Timely alerts will ensure that the erroneous credit report does not impede your Bajaj Finserv personal loan application.

Check Your Pre-Approved Offers

Some reputed lenders in the market offering customized personal loans to people who lack the adequate credit score to avail a standard loan. Keeping an eye on these offers ensures that you can avail a personal loan from Bajaj Finserv if you meet all other requirements for the same, apart from the credit rating.

Joint Loan

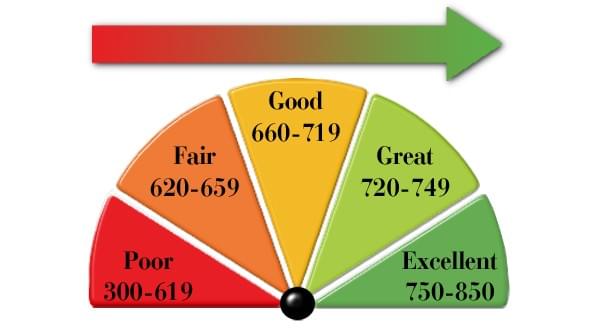

If a family member or friend has a credit score around or above 750, you can apply for a Bajaj Finserv Personal Loan jointly with them. In such cases, NBFC's can allow you to avail a higher sum due to the greater income after combining the co-applicants earnings. This is one of the simplest ways to apply for a personal loan with a low credit score.

Do Not Limit Yourself to Banks

NBFCs offer some of the best personal loans. For instance, Bajaj Finserv Personal Loan offers substantial sums at reasonable rates. Furthermore, these institutions often offer loans to people who lack a good credit score, which banks do not.

However, the best way to ensure hassle-free loan approval is to improve your credit rating.