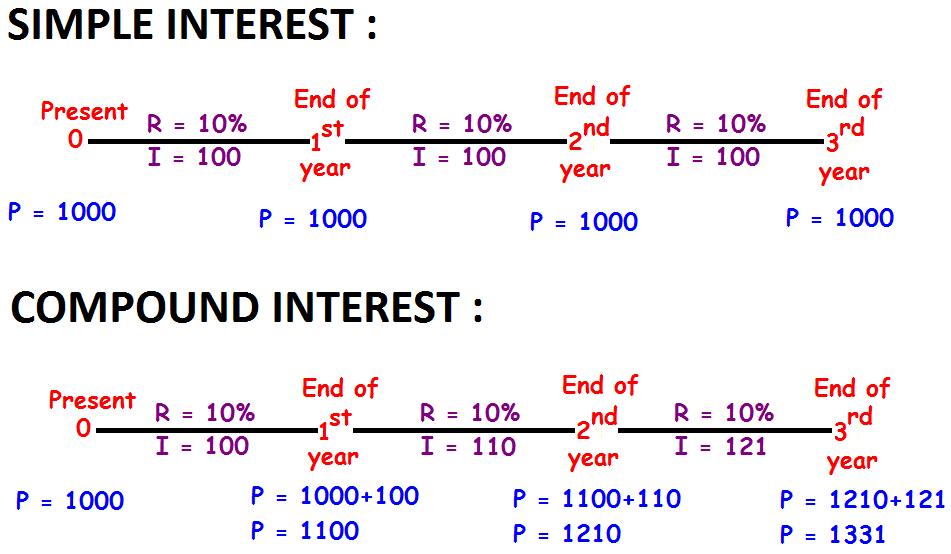

While taking a loan or making an investment, calculating the interest is the most integral thing to look out for. You can calculate the interest in two ways. The one way is simple interest, and the other way is compound interest. The simple interest and compound interest formula is P*R*N and P [(1+R]) n - 1] respectively, where (P = principal, R= rate and N = number of years)

The simple interest is discerned by multiplying the daily interest rate by the principal by the number of days between payments. It is quite an easy method to calculate it. Moreover, it is computed on the principal only. Therefore, you can avoid compound interest loans to save your money for the long term.

The interest payable is calculated based on the compounding period, which is tenor, and then added to the principal borrowed is known as compound interest. The compound interest is more complex and difficult to calculate in comparison to simple interest. The compound interest is higher than the simple interest. It is usually applicable to pay penalties or outstanding balances.

Simple and compound interest are basic financial concepts for borrowing or investing. The simple interest and compound interest formula can give you more invaluable insights and help you plan your finances for years to come. Knowing it can improve your ability to make borrowing and repayment decisions. It also saves your money.

For a high-value sanction on affordable terms, you can go with the Bajaj Finserv Personal Loan. You can avail of up to Rs. 25 lakh at an attractive interest rate. They provide 100% transparency with no hidden charges. It also ensures an entirely transparent borrowing experience, so that you get the utmost value.

Read Also: How does the Annual percentage rate work?