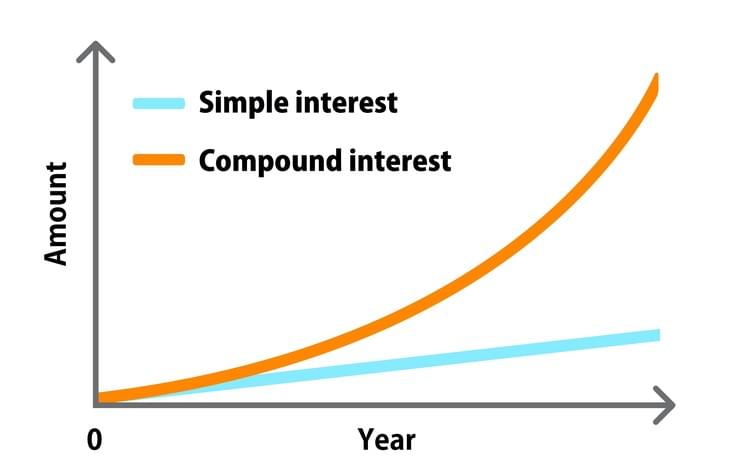

People often get confused when we talk about simple interest and compound interest and its related calculation. The banks provide these interests to their users on their bank deposits. The simple and compound interest formula is straightforward.

Simple interest

The simple interest is a prevalent form of bank interest and is not in fashion these days. Some of the banks still give this interest. Simple interest is calculated on a sum called the principal, and the rate often is higher than compound interest. Even the repo rate affects the Simple interest.

The formula-

The Simple Interest is calculated by -

SI= P*R*T/100

P= Principal amount that is being deposited in the bank.

R= Rate of the interest from the bank

T= It is the time for which the money is invested in the bank.

- Different banks have different rates that will give you the interest.

- Simple interest will also depend on the time you want to invest your money for.

Compound Interest

Compound Interest is not as simple as simple interest, and this complicated interest is the preferred one these days. Most commercial banks provide this interest. It is better and can give you high returns.

This interest is calculated on the amount, not like the principal. The amount is calculated after every month, which is basically the principal plus interest. In the next month, the interest is calculated on this sum.

It is preferred over simple interest as-

- Gives greater return

- It gives an efficient way of making money faster with low risk.

The Formula

A = P(1 + r/n)(nt)

P- The main principal balance

r- It is the rate of interest

n- It is the number of times out of which interest is calculated

Stay Tuned with All About Loans for more Finance Blogs.